BIOTIKA, a.s.

Sector: biotechnological production of pharmaceutical substances and Active Pharmaceutical Ingredients (API) through the fermentation technology, production of final dosage forms

Sector: biotechnological production of pharmaceutical substances and Active Pharmaceutical Ingredients (API) through the fermentation technology, production of final dosage formsYear of investment: 2004 – still in progress

Web: www.biotika.sk

Project

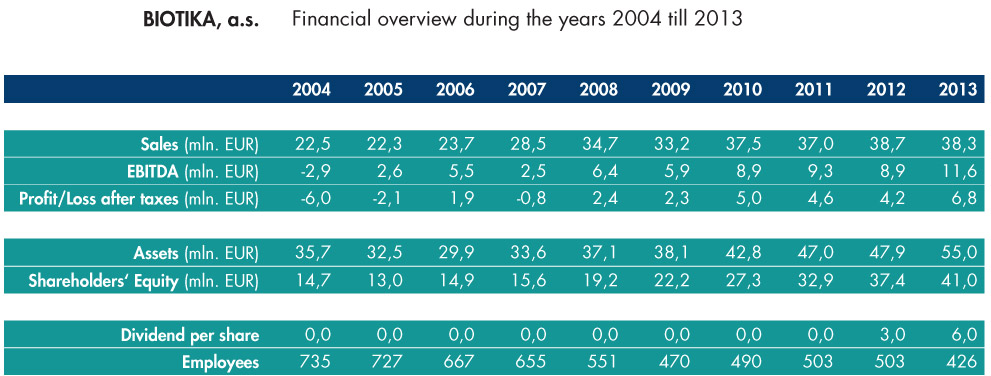

The goal of this project is to realize restructuring of the company and later sale of the company to a strategic investor. The total restructuring of the company is carried out with the aim to develop and efficiently produce products with higher added value based on the fermentation technology.

1. Regionální uzavřený investiční fond, a.s.

Year of investment: 2004 – still in progress

Current value of real estate: 1 000 mln CZK

Web: www.amista.cz

1. Regionální uzavřený investiční fond, a.s., (before MEI Czech Offices, a.s.) is a real estate project, which was a spin-off of the restrucuring project PVT, a.s. The real estate portfolio owned by PVT was bought by MEI Czech Offices, a.s. and this acquisition gained representations in all the regional capitals of the Czech Republic. After optimization the operations, the portfolio and its structure, the original portfolio was enlarged to currently 34 office buildings with a total area of more than 100.000 m2. The portfolio offers a comprehensive range of office space. Together with the lease of office space, is provided a high standard of services (reception, housekeeping, electronic security, virtual offices). Due to the excellent location of the buildings within the wider urban centers, the excellent transport accessibility, good condition of the buildings, the range of services offered and the quality of tenants the buildings enjoy a high occupancy.

The real estate portfolio is managed by MEI Property Services s.r.o.

For more information, visit: www.officesforrent.cz

MEI Property Services, s.r.o.

Year of investment: 2004 – still in progress

Turn over: more than 150 mln CZK (in 2013)

Web: www.komercnipronajmy.cz

MEI Property Services s.r.o. manages a number of real estate portfolio‘s in the Czech and Slovak Republic. The company offers a comprehensive range of services for the management of real estate projects: asset management, property and facility management and administrative support. The company manages real estates with a value of more than EUR 300 million. Currently, the flagship projects are: 1. Regionální uzavřený investiční fond, a.s., Palmer Capital Central European Properties, a.s., and Regionální nemovitosti, s.r.o.

The company focuses on management of office buildings in the B category, situated in the regional capitals and other major regional centers of both countries. Total floor area of buildings managed is approximately 500,000 m2. MEI Property Services is able to achieve superior yields of the managed assets, due to its active Asset and Property management.

Property Services SK, s.r.o.

Year of investment: 2005 – still in progress

Web: www.officesforrent.cz

Property and Facility management in the Slovak Republic. Company also produces and sales heat to the customers in the administrative buildings in its Slovak portfolio.

Regionální nemovitosti, s.r.o.

Acquisition of a portfolio of 37 buildings from Telefónica O2 CR, optimization of the building operations and subsequent sale of individual real estate to the local investors.

ÚSTÍ DEVELOPMENT, s.r.o.

Year of investment: 2004 – still in progress

Current value of real estate: 200 mln CZK

Liberec Castle - Information Brochure

Usti Development s.r.o. is a investment vehicle investing in Real Estate, currently it has properties in Usti nad Labem, Liberec and Jablonec nad Nisou. The majority of the portfolio are buildings for retail and office use. However in Liberec the company is owner of the Liberecky Zamek, a castle in the centre of the city.

Růženka Residence, s.r.o.

Year of investment: 2007 – still in progress

Project

The Budovatel project concerns the development of a new accommodation complex at Velká Úpa in the Giant Mountains, involving the reconstruction of the hotel Budovatel built back in the 1930s, plus the construction of an extention on plots of land covering 9455 square metres.

The original object was built in the 30ties as a luxury hotel with its own restaurant and full-scale background facilities. The hotel has been abandoned approximately since 1999. The first stage of the project plans to restore the hotel to its original use, together with a new annex expanding the hotel’s accommodation capacity

Locality

The project is situated in the very centre of Velká Úpa, on the right bank of the Úpa river, along the main road for Pec pod Sněžkou. The locality is easily accessible from Prague, Hradec Králové, Liberec, as well as from Poland, Germany and many other places. Its excellent position will be further improved by the planned development of ski centres, ski lifts and courses in the vicinity.

Current Status

At present the project is in a preparatory stage.

Pec Development, a.s.

Project

The project Pec Development envisages the development of the Vlčice area. The original project envisages the construction of two apartment houses at the edge of the Velká Úpa municipality in the Giant Mountains, close to the town of Pec pod Sněžkou.

Locality

Situated at the edge of Velká Úpa, on the right bank of the river, this project is easily accessible from the centre of Velká Úpa and Pec pod Sněžkou. In the winter season, it will offer comfortable transport to the ski centres at Pec and its surroundings. Velká Úpa – Pec pod Sněžkou is easily accessible from Prague (160 km), Germany (the Czech-German border is approximately 120 km away) and Poland.

Current Status

The territory permission was granted to the project in 2006. The realization of the project has been postponed.

Yellow Properties, a.s.

Year of investment: 2008 – 2012

Investment: 125 mln CZK

Web: www.drahobejlova.cz

Development and construction of a modern multifunctional complex with a predominance of residential function, which is architecturally linked with surrounding existing buildings. Commercial space located in the ground floor of the building will offer services not only to the future residents of the house but also to the nearby area. In the other floors of the building will be located 86 residential units ranging from 1 + kk to 4 + kk, most apartments will have a private terrace or balcony. Underground parking beneath the newly constructed buildings will offer 78 parking spaces.

The Planning permission was granted in 2010, building permit was issued in September 2011. Construction began in January 2012.

The project was part of the Fund´s assets that were sold to Palmer Capital in 2012.

Palmer Capital Emerging Europe Property Fund N.V.

Year of investment: 2003 – 2012

Current value of real estate: 60 mln EUR

Web: www.palmercapital.nl

This real estate Fund includes real estate assets in Slovakia and Czech Republic.. The fund is since 2003 listed on the stock exchange NYSE Euronext in Amsterdam. The fund was after the sale of MEI Netherlands in 2012 renamed from MERE to Palmer Capital Emerging Europe Properte Fund N.V. The fund invests in a portfolio of commercial real estates diversified by type, size, location and class. The dominant type of property are office buildings. Currently the Fund ownes almost 155.000 m2 of commercial space in 18 building complexes in the Czech Republic (Prague, Brno) and the Slovak Republic (Bratislava, Košice).

After the sale of the fund management to Palmer Capital in 2012, MEI in the Czech Republic has remained a significant minority shareholder in the fund.

Palmer Capital Central European Properties, a.s.

Year of investment: 2008 – 2012

Current value of real estate: 1.600 mln CZK

Palmer Capital Central European Properties, a.s. (before MEI Properties, a.s.) became in 2008 the owner of 69 office buildings, which were bought from Telefónica O2. The office buildings are located in all regional capitals and other major regional centers in the Czech Republic. The buildings have about 265.000 m2 of office space and tens of thousands of square meters of usable land. The buildings are, due to their good location, good standard equipment and supply of services attractive for commercial rentals to businesses and for public administration authorities.

MEI Property Services is providing the property management services to Palmer Capital Central European Properties, a.s.

Úvaly Development, s.r.o. / Hostín Development, s.r.o.

Year of Investment: 2007 – 2012

Investment: 10,000,000 EUR

Web: www.bydleniuvaly.cz

Acquisition of 690.000 m2 of land in Úvaly. The aim of the project is to create a new modern district.

Change of the master plan of the first phase of the project was approved in April 2009 and the second phase in May 2010. Territorial study was approved by the city council in May 2009 and zoning permission for the 1st phase of the project was issued in December 2009.

The project was part of the Fund´s assets that were sold to Palmer Capital in 2012.

ISAN Radiátory, s.r.o.

Sector: Production of radiators

Sector: Production of radiatorsYear of investment: 2005 – 2014

Investment: 525,000 EUR

Web: www.isan.cz

ISAN Radiators s.r.o. is the largest manufacturer of bathroom tubular radiators in the Czech Republic, exporting 90% of its production abroad, mainly to the European Union. Delivering a broad range of bathroom radiators, convectors, radiant, lamellar radiators, convectors and floor radiators.

The stake in ISAN Radiatory was sold to the company AMTEX B.V.

OSTROJ a.s.

Sector: Manufacturing of mining machinery

Sector: Manufacturing of mining machineryYear of investment: 2008 – 2013

Investment: 754,000 EUR

Web: www.ostroj.cz

OSTROJ a.s. is a leading manufacturer of mining machinery suitable for any deep mining conditions plus a range of other engineering products. With over 60 years of manufacturing experience, the company is able to provide turn-key solutions and a full range of coalface equipment for coalfaces, including longwall mining operations.

The stake in the Ostroj was sold in 2013.

PARAMO, a.s.

MEI owned 14,5% of the shares of the company Paramo, a.s. Paramo is a well known producer of fuels, motor oils, metal-working fluids, process oils and corrosion preventives, synthetic lubricants, bituminous products for waterproofing and road bitumens.

In 2007, MEI sold its stake to the majority shareholder of the company PKN Orlen for 9 mil. EUR.

SLOVNAFT, a.s.

MEI was minority shareholder in this company. The shares were sold with a yield of 45%. SLOVNAFT, a.s. with seat in Bratislava is the refinery and petrochemical company with annual processing of 5.5 - 6 million tons of crude oil. The company is besides the production, storage, distribution and wholesale of oil products owner of the largest fuel station retail chain in the Slovak Republic. It is focused on the sale of fuels and lubricants and in providing a wide range of services to motorists.

ČKD Praha DIZ, a.s.

Sector: Engineering

Sector: EngineeringYear of investment: 2000 – 2007

Investment: 2,500,000 EUR

Web: www.ckddiz.cz / www.ckd.cz

MEI was a long-term minority shareholder of CKD Praha DIZ, a.s. The company is a supplier of technological investment units or their parts, including upgrade and rebuilding, in the segments of gas and oil, power, infrastructure and ecology.

In 2007, MEI has sold 39,55% of the shares of CKD Praha DIZ, a.s. and 4% of the shares of CKD Praha Holding, a.s. to the majority shareholder. The shares were sold with a yield of 100%.

Severočeské doly, a.s.

Sector: Mining of brown coal

Sector: Mining of brown coalYear of investment: 1998 – 2006

Investment: 200,000 EUR

Web: www.sdas.cz

MEI was minority shareholder in this company. Severoceske doly, a.s. is the largest brown coal mining company in the Czech Republic. Established on 1 January 1994 by the merger of Doly Nástup Tušimice and Doly Bílina in the North Bohemian brown coalfield. Engaged in mining, processing and sales of coal and related raw materials. The sole shareholder and largest customer is ČEZ, a.s.

PVT, a.s.

Sector: Information technology

Sector: Information technologyYear of investment: 2003 – 2004

Investment: 21,500,000 EUR

Web: www.asseco.com

PVT, a.s. has been the leading company in the field of information technology and system integration in the Czech Republic. MEI formed an consortium with the investment group J&T and Polish Prokom Software S.A. for the restructuring of the company. The IT core-business was subsequently sold to the strategic investor Prokom Software S.A. The majority of the real estate was bought by MEI Czech Offices. The shares were sold with a yield of 45% in 2004.

Metrostav, a.s.

Sector: Construction

Sector: ConstructionYear of investment: 2001 – 2002

Investment: 2,100,000 EUR

Web: www.metrostav.cz

METROSTAV a.s.. is a universal construction company providing management and implementation of challenging construction projects. It operates in all fields of the construction industry throughout the Czech Republic with the center in Prague. In a unique segment of the underground construction has dominant position.

MEI acquired in 2001 approximately 10% of the shares of Metrostav. In 2002, the shares were sold with a yield of 78%.

Hutní montáže, a.s.

Sector: Engineering

Sector: EngineeringYear of investment: 2002 – 2005

Investment: 750,000 EUR

Web: www.hutni-montaze.cz

Hutní Montáže, a.s. had been established with the main objective to create production capacity for metallurgical engineering and heavy industry. The production program included the production of steel structures for transmitters, bridges, chemical plants, power plants, cement plants etc. The company had many subsidiaries, of which were the most important Mostárna Hustopeče, a.s. a Hutní stavby, a.s.

MEI was part of a consortium led by Jet Investment, which restructured the company with the subsequent sale to a strategic investor.

SLOVAKOFARMA, a.s

Sector: Pharmaceutical industry

Sector: Pharmaceutical industryYear of investment: 2003 – 2004

Investment: 2,650,000 EUR

Web: www.zentiva.cz

MEI was minority shareholder in this company. The shares were sold with a yield of 68% in 2004. SLOVAKOFARMA a.s. was the Slovak pharmaceutical company that enabled by the merger with Czech pharmaceutical company Léčiva, a.s. to arise a larger and stronger company Zentiva, which is still successfully operating on the Czech and international final dosage forms market (mainly in CEE). Zentiva is a member of global pharmaceutical group Sanofi

SILON, a.s.

Sector: Producer of technical compounds and polyester staple fibers

Sector: Producer of technical compounds and polyester staple fibersYear of investment: 2000 – 2004

Investment: 400,000 EUR

Web: www.silon.cz

MEI was minority shareholder in this company. The shares were sold with a yield of 200%. SILON designs, produces and sells polyolefin based performance compounds and polyester fibers for applications in construction, the automotive industry, for hygienic and medical applications and for general processing.

VINIUM a.s.

Sector: Production a distribution of wine

Sector: Production a distribution of wineYear of investment: 2001 – 2003

Investment: 900,000 EUR

Web: www.vinium.cz

Moravian wine company with a history dating back to 1936, with vineyards covering an area of 2500 ha. The portfolio includes vineyards in the following sub-areas: Velke Pavlovice, Mikulov, Znojmo and Slovácko.

MEI was part of a consortium led by Jet Investment, which restructured the company with the subsequent sale to a strategic investor. MEI enjoyed a yield of 68% in the project.

GUMOTEX, a.s.

MEI was minority shareholder in this company. The shares were sold with a yield of 130%. GUMOTEX one of the largest Czech manufacturer of flexible polyurethane foams. An important role is also played in the rubber and textile materials. Is known in the production of comfortable mattresses for healthy sleep quality inflatable boats and other products for sport and leisure.

Česká gumárenská společnost, a.s.

MEI was minority shareholder in this company. The shares were sold with a yield of 125%. Česká gumárenská společnost is is a holding company with a comprehensive portfolio of rubber production in the Czech Republic. Core business companies across the group are Mitas and Rubena producing a wide range of tires, tubes and products from technical rubber..

TEROSIL, a.s.

Sector: Production of silicon wafers and silicon single crystals

Sector: Production of silicon wafers and silicon single crystalsYear of investment: 1999 – 2003

Investment: 250,000 EUR

Web: www.onsemi.com

MEI was minority shareholder in this company. Terosil was a manufacturer of silicon wafers and silicon single crystals for use in the semiconductor industry. The company is now part of On Semiconductor Inc.

Českomoravský len, a.s.

Year of investment: 2000 – 2002

Investment: 625,000 EUR

Českomoravský len is a company based in Humpolec, which was founded as a manufacturer of flax fiber and related products. Gradually, the company began to produce a particle board, MDF and started to develop and produce machines for processing flax. The strategy was to acquire a majority stake in the company and sell the various parts of the company separately to different strategic investors.

MEI was part of a consortium led by Jet Investment, which restructured the company with the subsequent sale to a strategic investor. MEI enjoyed a yield of 100% in the project.

Železniční stavitelství Praha a.s.

MEI was minority shareholder in this company. The shares were sold with a yield of 250%. Železniční stavitelství Praha a.s. specialized in a construction and maintenance of railway infrastructure and later in a Prague underground metro. The company is now part of Skanska group.

Kaolin Hlubany, a.s.

Year of investment: 1997 – 1999

Investment: 250,000 EUR

Web: www.sibelco.com

MEI was minority shareholder in this company. The shares were sold with a yield of 90%. Kaolin Hlubany is one of the largest producers of crude and refined kaolin in Central Europe with production located about 100 km west of Prague. The main customers are companies producing porcelain, sanitary ware, durable and regular tiles.

In 1999 the company was sold to WBB Group located in the western part of Germany. Currently is the company member of Belgian group with the global activities SIBELCO.

Sector: Refinery

Sector: Refinery Sector: Refinery

Sector: Refinery Sector: Rubber industry

Sector: Rubber industry Sector: Rubber industry

Sector: Rubber industry